The imminent return of Boeing MAX’s to service raises questions about how valuers will regard, in particular, aircraft that have been built then stored long-term. It may require a nuanced, aircraft-by-aircraft approach, suggests Mike Yeomans, an ISTAT Certified Senior Appraiser and Director of Valuations at IBA.

Recent news reports have suggested the MAX is expected to return by the year-end but we believe a more realistic and meaningful return will happen by the second quarter of 2021. It will take time for aircraft built and now in storage to undergo necessary modifications, for staff to be trained and for all regulatory considerations to be addressed.

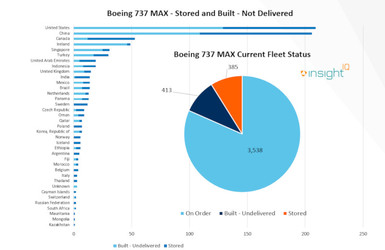

Using data from our new data intelligence platform InsightIQ, we have calculated a total of nearly 800 aircraft have been built by Boeing, 385 of which were delivered then stored and the remaining 413 have yet to be delivered. A wide range of global customers are involved across all regions of the world and certification is unlikely to be uniform. Naturally, the FAA will be first to certify followed by EASA. The Chinese authority CAAC is expected to be slower.

More than 200 of the aircraft are in the US and Boeing had announced 450 MAXs would be delivered next year. They have revised this, however, now forecasting they will deliver half in 2021 and the rest in 2022.

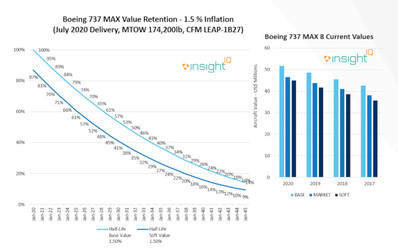

As illustrated in the charts below, using data from InsightIQ, we have not adjusted base values for the MAX; there is still enough of a backlog to support a liquid secondary market trading environment which is central to our base value opinions. Although market values have dipped below base, they are holding slightly above soft.

We have been asked how we will value aircraft which have been built then stored long-term. Although we will use the aircraft’s delivery date to determine its vintage, we will incorporate a penalty adjustment to recognise the difference in market perception of aircraft that have been in storage for extended periods. This adjustment is likely to be short-term and we may have to take a more nuanced approach on an aircraft-by-aircraft basis.

IBA’s InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

This article first appeared in Aviation Finance, November 2020